Best Mobile Apps for Managing Finances and Budgeting

Managing personal finances has become easier with the advancement of mobile technology. Today, there are numerous apps designed to help users track their spending, create budgets, and manage their savings. Whether you’re trying to save for a big purchase or simply want to track where your money goes each month, there’s an app for that. Below, we explore some of the top mobile apps for managing finances and budgeting as of November 2024. These apps provide various tools and features that can help you stay on top of your finances, monitor your spending, and reach your financial goals.

Mint – The All-in-One Financial Management Tool

Mint is one of the most popular and widely used apps for managing personal finances. It offers a comprehensive solution for budgeting, tracking expenses, and monitoring bank accounts. Mint connects to all your financial accounts, including credit cards, bank accounts, and investment portfolios, providing you with an overview of your finances in one place.

With Mint, you can automatically categorize your transactions, which saves you time and effort when tracking your expenses. The app helps you set up budget goals for specific categories like groceries, utilities, and entertainment. It also provides reminders for bill payments and sends alerts for unusual spending patterns, making it easier to stay on top of your financial obligations.

Features of Mint

One of the most useful features of Mint is its credit score tracker, which allows you to monitor your credit score for free. This is valuable for users who want to stay informed about their financial health. Additionally, Mint generates reports on your spending, providing you with a clear picture of where your money goes each month. The app’s goal-setting features allow you to set savings goals and track your progress toward them.

Mint is free to use, though it may display some ads related to financial products. Some users may find these ads intrusive, but for the most part, Mint is a great tool for those who need an all-in-one financial management solution. Overall, it’s a solid choice for people looking to track their spending, set budgets, and improve their financial health.

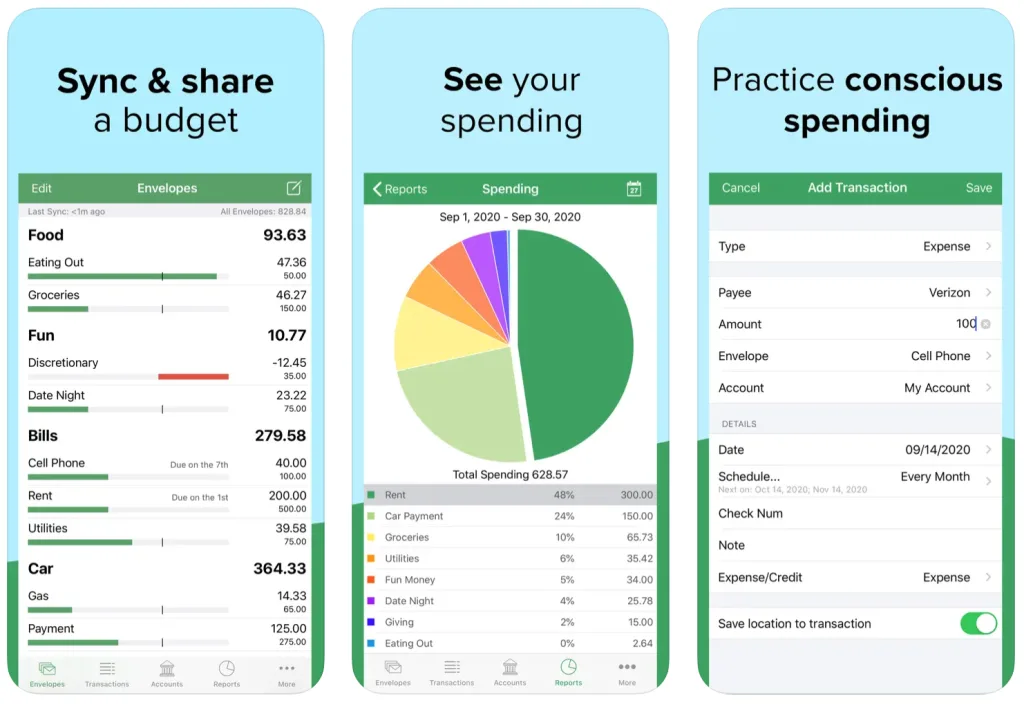

YNAB (You Need A Budget) – The Ultimate Budgeting App

YNAB is a budgeting app designed to help you take control of your finances by teaching you how to manage money rather than just tracking it. This app focuses on a unique budgeting method called “zero-based budgeting,” where every dollar is given a specific purpose, whether it’s for spending or saving. It is especially useful for people who want to break the cycle of living paycheck to paycheck.

YNAB offers a structured approach to budgeting, where you allocate funds to specific categories and plan ahead for upcoming expenses. The app allows you to track your progress in real-time and adjust your budget as needed, helping you stay within your means each month.

Features of YNAB

YNAB helps you plan every dollar in advance, giving you more control over your finances. It allows you to categorize your expenses, set goals for saving, and receive real-time updates on your budget. YNAB syncs across multiple devices, so you can access your budget from anywhere. Additionally, YNAB offers educational resources that teach users the basics of budgeting and help them develop better money management habits.

While YNAB is a paid service, with a subscription fee, it offers valuable tools and budgeting techniques that make it worth the cost for many users. The app’s interface is user-friendly, and its educational resources are particularly useful for those new to budgeting or looking to take their financial planning to the next level.

PocketGuard – Simplified Financial Tracking

PocketGuard is an app that provides a simple and intuitive way to track your spending without the complexity of other financial apps. The app connects to your bank accounts, credit cards, and investment accounts to provide an overview of your finances. It automatically categorizes your expenses, allowing you to see where your money is going and how much you have left to spend in various categories.

One of the standout features of PocketGuard is the “In My Pocket” feature, which shows you how much money you can spend safely after accounting for bills, goals, and savings. This helps prevent overspending and allows you to budget more effectively. The app also provides suggestions for saving more based on your spending habits.

Features of PocketGuard

PocketGuard’s simplicity is one of its biggest advantages. The app automatically tracks your transactions, categorizes them, and provides you with a clear view of your spending patterns. It’s perfect for those who want a straightforward, no-frills tool for managing their finances. Additionally, the app helps you stay on top of your savings goals by suggesting ways to reduce unnecessary expenses.

While the app offers a free version, the premium version unlocks additional features like the ability to track cash expenses and connect to more bank accounts. Overall, PocketGuard is great for users who want a simple way to stay on budget without spending too much time managing their finances.

Personal Capital – Comprehensive Financial Planning

Personal Capital is a hybrid app that combines budgeting tools with retirement planning and investment tracking. It’s ideal for users who want to manage their day-to-day finances while also planning for the future. Personal Capital allows you to track both your spending and investments in one app, giving you a more holistic view of your financial health.

The app connects to your financial accounts, including bank accounts, credit cards, and investment portfolios, and provides detailed insights into your financial situation. Personal Capital’s dashboard helps you track your net worth, monitor your spending, and analyze your investment performance.

Features of Personal Capital

One of Personal Capital’s strongest features is its investment tracking tools. The app allows you to see how your investments are performing, monitor your portfolio’s asset allocation, and track your progress toward retirement. It also provides a real-time overview of your financial situation, including your assets, liabilities, and overall net worth.

While Personal Capital offers many features for free, users can also opt for the premium version, which includes personalized financial advice and more in-depth investment analysis. For those interested in managing both their personal finances and retirement savings, Personal Capital is a comprehensive and valuable tool.

GoodBudget – Envelope Budgeting for the Modern Age

GoodBudget is a digital version of the traditional envelope budgeting method. With this app, you can create virtual envelopes for different spending categories, such as groceries, entertainment, or gas. As you make purchases, you assign them to the relevant envelope, ensuring that you stay within your budget for each category.

GoodBudget is a simple, manual budgeting tool that doesn’t connect directly to your bank accounts. Instead, you enter your income and expenses manually, which gives you full control over your budget. This makes the app a great choice for people who want to take a hands-on approach to budgeting without relying on automated features.

Features of GoodBudget

GoodBudget allows you to plan your budget ahead of time by allocating funds to specific categories. You can track your progress and adjust your budget as needed. The app syncs across multiple devices, making it easy to stay on top of your finances no matter where you are. It’s perfect for users who prefer to manage their money manually and who want full control over every aspect of their budget.

GoodBudget offers a free version, as well as a premium version that includes additional features like unlimited envelopes and syncing across more devices. While the manual nature of the app may be a drawback for some users, it’s an excellent tool for people who want a more traditional approach to budgeting.

Conclusion: Choosing the Right Financial App

Choosing the best mobile app for managing your finances ultimately depends on your unique financial situation and personal preferences. Whether you prefer an all-in-one tool like Mint, a goal-based app like YNAB, or a simple expense tracker like PocketGuard, there are numerous apps available to help you take control of your finances. Consider what features matter most to you, such as ease of use, automation, or investment tracking, and select the app that best fits your needs. Regardless of which app you choose, taking the time to manage your finances with a mobile tool is an important step toward achieving financial stability and long-term financial success.